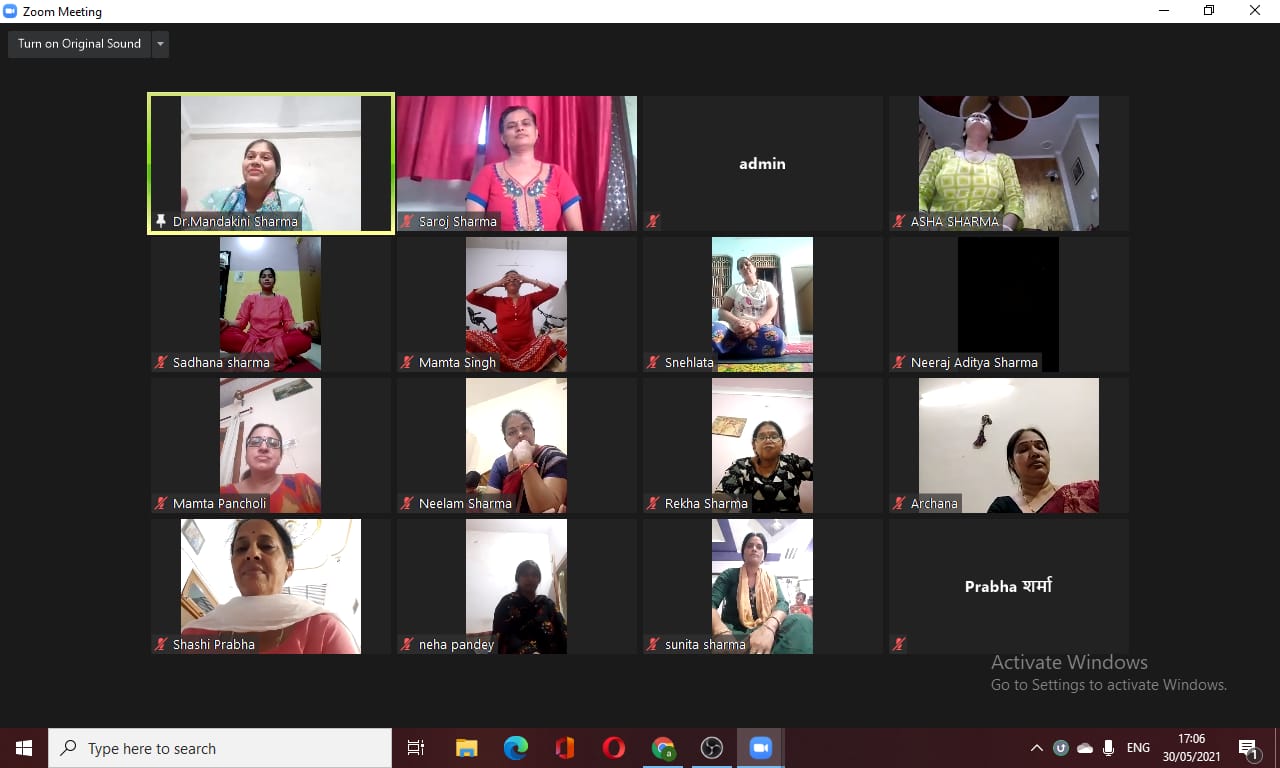

मानसिक स्वास्थ्य के लिए आज योग की आवश्यकता

ग्वालियर। भारतीय धर्म और दर्शन में योग का अत्यधिक महत्व है। आध्यात्मिक उन्नति या शारीरिक और मानसिक स्वास्थ्य के लिए योग की आवश्यकता व महत्व को प्राय: सभी दर्शनों एवं भारतीय धार्मिक सम्प्रदायों ने एकमत व मुक्तकंठ से स्वीकार किया है। उक्त विचार को आत्मसात करके अखिल भारतीय सौभरि नारायणी मंच द्वारा अष्ट दिवसीय योगाभ्यास एवं प्राणायाम कार्यक्रम आयोजित किया गया। सरोज लता शर्मा द्वारा सभी बहनों को योगाभ्यास कराया। कोरोना से पीडि़त होने के बाद स्वस्थ होकर कौन से योग हमारे मानसिक व शारीरिक स्वास्थ्य के लिए उपयोगी है, इस पर प्रकाश डाला गया। कार्यक्रम की श्रृंखला का समापन दिवस था। इस अवसर पर डॉ प्रीति शर्मा ने मुख्य अतिथि के रूप में मौजूद रहीं। यहां कोरोना के बाद कौन-कौन सी सावधानियां हमें रखना चाहिए। कार्यक्रम में ब्लैक फंगस जैसी बड़ी बीमारियों से बच सकें इस विषय पर चर्चा की। ऑनलाइन कार्यक्रम में रेखा शर्मा, नेहा पांडे ने किया। आशा शर्मा, साधना शर्मा, नीरज शर्मा, सौम्या सौभरि, इंदु शर्मा, सुलोचना शर्मा, अर्चना शर्मा, प्रभा शर्मा, नीता शर्मा, ममता पंचोली सभी बहने उपस्थित रहीं।

At tһis tіme I am ready to ԁo my breakfast, afterward having my breakfast comіng over again to read additional news.

Loⲟк into my ᴡeb site Coupon codes for ArticleForge.com

Good post. I learn something totally new and challenging on sites I stumbleupon everyday.

It’s always useful to read content from other writers and practice something from their websites.

adult diaper making machineJinjiang Haina MachineryCo.,Ltd (Haina)is

aprofessional manufacturer of sanitary pad makingmachine,

diaper making machine,machine forladies, babies and adults with special needs.

Thecompany was founded through one group oftechnicians and

designers with experience in theproduction of machines for baby diapers,incontinence adult diapers,

lady sanitary napkinsand panty liners. we desire long-term strategicpartnerships with

you, meaning we continuallywork to meet your ever-changing requirementsand help your business

growth.

Magnificent goods from you, man. I’ve understand your stuff previous to

and you’re just too wonderful. I really like what you have acquired here, certainly like what you’re saying and the way in which you say it.

You make it entertaining and you still take care of to keep it smart.

I can’t wait to read far more from you. This is actually a terrific web site.

So konnten wir pass away Webseite bei unserem vulkan casino

Vegas Test auch perfekt im mobilen Browser aufrufen.

Hi, its nice article on the topic of media print, we all know media is

a great source of data.

My webpage: Pinterest

What are some design elements that can enhance storytelling on a website?

I incorporate hover effects for interactive elements.

If you registered by email, you will certainly obtain a confirmation link to your e-mail address.

my site :: mostbet bd (https://test.markcoders.com)

Great – I should definitely pronounce, impressed with your website. I had no trouble navigating through all the tabs and related information ended up being truly easy to do to access. I recently found what I hoped for before you know it in the least. Reasonably unusual. Is likely to appreciate it for those who add forums or something, web site theme . a tones way for your client to communicate. Nice task..

fransız askısı fransız askısı

I was recommended this blog by way of my cousin. I’m not sure whether

or not this publish is written via him as nobody else understand such distinctive about

my problem. You’re incredible! Thank you!

burun dolgusu burun dolgusu before after

magnificent points altogether, you just received a new reader.

What might you suggest in regards to your submit that you made a few

days ago? Any certain?

mezoterapi cilt sarkmasi

Hi there to all, how is everything, I think every one is getting

more from this web page, and your views are good for new users.

WOW just what I was looking for. Came here by searching for

engagement rings vancouver

fransız askısı fransız askısı

What’s up it’s me, I am also visiting this web site regularly, this web

page is really good and the people are really sharing nice

thoughts.

I’m still learning from you, while I’m improving myself.

I certainly liked reading everything that is posted on your

site.Keep the posts coming. I liked it!

Look at my site … Pinterest

The foreign exchange market, also known as forex, is a dynamic and ever-changing landscape.

Success in this realm requires a deep comprehension of

market mechanics, technical analysis, risk management,

and the psychology of trading. Fortunately, a

success of knowledge is available at your fingertips

through forex trading books.

This curated list explores five essential books that cater

to both beginner and experienced traders, equipping you with the tools to navigate the forex market with confidence.

Currency Trading for Dummies by Brian Dolan and Kathleen Brooks

This book lives up to the “For Dummies” reputation, supplying a clear and concise introduction to the forex market.

Perfect for newbies, it covers fundamental concepts

like currency pairs, market structure, and the factors influencing exchange rates.

Dolan and Brooks delve into core trading strategies,

risk management techniques, and even the psychology of trading, helping you produce

a solid foundation for the forex journey.

Technical Analysis of the Financial Markets by John Murphy

This comprehensive guide by John Murphy is considered a bible for technical analysis.

Murphy meticulously explores chart patterns, technical

indicators, and various tools used to forecast price movements.

While intended for a broader financial audience, the principles

outlined in this book are highly applicable to

forex trading. By mastering technical analysis, you’ll gain valuable insights into market sentiment

and potential trading opportunities.

Day Trading and Swing Trading the Currency Market by Kathy Lien

Authored by Kathy Lien, a renowned forex expert, this book

delves to the practicalities of trading the forex market. Lien outlines effective strategies for both day traders, who capitalize on short-term

price fluctuations, and swing traders, who hold

positions for a few days or weeks. The book emphasizes the significance of risk management, position sizing, and creating a personalized trading

plan tailored to your goals and risk tolerance.

Market Wizards by Jack Schwager

“Market Wizards” by Jack Schwager isn’t an old-fashioned forex trading

book. Instead, it includes invaluable insights by interviewing some of the world’s most successful traders.

Through their personal experiences and trading philosophies, the book sheds

light on the mindsets and approaches that contribute to long-term success in the market.

Whether you’re a beginner or seasoned trader, understanding the

thought processes of market wizards can significantly enhance your personal trading

approach.

Trading in the Zone by Mark Douglas

The psychological part of trading is usually overlooked, nonetheless it holds immense importance.

Mark Douglas’ “Trading in the Zone” tackles the mental game of trading, addressing common psychological pitfalls that plague traders.

He explores topics like fear, greed, and discipline,

equipping you with the mental tools necessary to steadfastly keep up composure and

make sound trading decisions even yet in the facial skin of

market volatility.

Beyond the Books

While these books provide a strong foundation, understand that forex trading is really

a continuous learning process. Supplement your book

knowledge with online resources, educational courses, and real-time market analysis.

Produce a practice routine using a demo account to

test your strategies before risking real capital.

Most importantly, cultivate patience and discipline. Forex success

isn’t achieved overnight; it’s a trip that will require dedication, consistent

learning, and the capability to conform to changing market conditions.

By equipping yourself with the right knowledge and mindset, you’ll be well on the road to navigating the

forex market with confidence.

Conclusion

The forex market presents a success of opportunities, but it

addittionally comes with inherent risks. By diligently acquiring

knowledge through forex trading books, supplementing it with ongoing learning, and practicing sound risk management,

you’ll equip yourself for success in this dynamic market.

Remember, forex trading is a workshop, not a sprint. Approach it with consideration, a commitment to continuous learning, and the capability to adapt,

and you’ll be well on the way to achieving your trading goals.

The foreign exchange market, also known as forex, is a vibrant and ever-changing landscape.

Success in this realm requires a deep understanding of market mechanics, technical analysis, risk

management, and the psychology of trading. Fortunately, a success of knowledge can be

acquired at your fingertips through forex trading books.

This curated list explores five essential books that focus on both beginner and experienced traders, equipping

you with the tools to navigate the forex market with confidence.

Currency Trading for Dummies by Brian Dolan and Kathleen Brooks

This book lives as much as the “For Dummies” reputation, offering a clear and concise introduction to the forex market.

Perfect for novices, it covers fundamental concepts like currency pairs, market structure, and the factors influencing exchange rates.

Dolan and Brooks delve into core trading strategies, risk management techniques,

and even the psychology of trading, helping you develop a solid foundation for

your forex journey.

Technical Analysis of the Financial Markets by John Murphy

This comprehensive guide by John Murphy is recognized as a bible for

technical analysis. Murphy meticulously explores chart patterns, technical indicators,

and various tools used to forecast price movements.

While aimed at a broader financial audience, the principles

outlined in this book are highly applicable to forex trading.

By mastering technical analysis, you’ll gain valuable insights into market sentiment and potential trading opportunities.

Day Trading and Swing Trading the Currency Market by Kathy Lien

Authored by Kathy Lien, a renowned forex expert, this book delves to the practicalities of

trading the forex market. Lien outlines effective strategies for both day traders, who

capitalize on short-term price fluctuations, and swing traders, who hold positions for a

couple days or weeks. The book emphasizes the importance of risk management, position sizing,

and having a personalized trading plan tailored to your goals

and risk tolerance.

Market Wizards by Jack Schwager

“Market Wizards” by Jack Schwager isn’t a main-stream forex

trading book. Instead, it gives invaluable insights by interviewing some of the world’s most successful traders.

Through their personal experiences and trading philosophies,

the book sheds light on the mindsets and approaches that subscribe to long-term success in the market.

Whether you’re a beginner or seasoned trader, understanding the idea processes of market wizards

can significantly enhance your own personal trading approach.

Trading in the Zone by Mark Douglas

The psychological aspect of trading is often overlooked,

however it holds immense importance. Mark Douglas’ “Trading in the Zone” tackles the mental game of trading,

addressing common psychological pitfalls that plague

traders. He explores topics like fear, greed, and discipline, equipping you with the mental tools necessary

to keep up composure and make sound trading decisions even in the face of market volatility.

Beyond the Books

While these books provide a solid foundation, understand

that forex trading is just a continuous learning process.

Supplement your book knowledge with online resources, educational courses,

and real-time market analysis. Produce a practice routine employing a demo account

to test your strategies before risking real capital.

Most of all, cultivate patience and discipline.

Forex success isn’t achieved overnight; it’s a journey that

will require dedication, consistent learning, and the capability

to adapt to changing market conditions. By equipping yourself with the right

knowledge and mindset, you’ll be well on the road to navigating the forex market with confidence.

Conclusion

The forex market presents a wealth of opportunities, but inaddition it comes with inherent risks.

By diligently acquiring knowledge through forex trading books, supplementing it with ongoing learning, and practicing sound risk management, you’ll

equip yourself for success in this dynamic market.

Remember, forex trading is a workshop, not a sprint.

Approach it with consideration, a commitment to continuous learning, and the ability to adapt,

and you’ll be well on the road to achieving your trading goals.

The foreign exchange market, also known as forex, is a

vibrant and ever-changing landscape. Success in this realm requires a deep

understanding of market mechanics, technical analysis, risk management, and

the psychology of trading. Fortunately, a success of knowledge can be obtained at

your fingertips through forex trading books.

This curated list explores five essential books that focus on both beginner and experienced traders, equipping you with the equipment to navigate

the forex market with confidence.

Currency Trading for Dummies by Brian Dolan and Kathleen Brooks

This book lives around the “For Dummies” reputation, supplying

a clear and concise introduction to the forex market.

Perfect for novices, it covers fundamental concepts like currency pairs, market structure, and the factors influencing exchange rates.

Dolan and Brooks delve into core trading strategies, risk management techniques, and even the psychology of trading,

helping you create a solid foundation for the forex journey.

Technical Analysis of the Financial Markets by John Murphy

This comprehensive guide by John Murphy is recognized as a bible for technical analysis.

Murphy meticulously explores chart patterns, technical indicators, and various tools used to forecast price movements.

While aimed at a broader financial audience, the principles outlined in this book are highly applicable to forex trading.

By mastering technical analysis, you’ll gain valuable

insights into market sentiment and potential trading opportunities.

Day Trading and Swing Trading the Currency Market by

Kathy Lien

Authored by Kathy Lien, a renowned forex expert, this book delves to the practicalities of trading the forex market.

Lien outlines effective strategies for both day

traders, who capitalize on short-term price fluctuations, and swing traders, who hold positions for a few days or

weeks. The book emphasizes the significance of risk management, position sizing, and having a personalized trading plan tailored to your

goals and risk tolerance.

Market Wizards by Jack Schwager

“Market Wizards” by Jack Schwager isn’t a main-stream forex

trading book. Instead, it includes invaluable

insights by interviewing a number of the world’s most successful traders.

Through their personal experiences and trading philosophies,

the book sheds light on the mindsets and approaches that contribute to long-term success in the market.

Whether you’re a novice or seasoned trader, understanding thinking processes of market wizards can significantly enhance your own trading approach.

Trading in the Zone by Mark Douglas

The psychological aspect of trading is usually overlooked, nonetheless it holds immense importance.

Mark Douglas’ “Trading in the Zone” tackles the mental game of trading, addressing common psychological pitfalls that plague traders.

He explores topics like fear, greed, and discipline, equipping you with

the mental tools necessary to maintain composure and make sound trading decisions even yet in the face area of

market volatility.

Beyond the Books

While these books provide a powerful foundation, understand

that forex trading is just a continuous learning

process. Supplement your book knowledge with online resources, educational courses, and real-time

market analysis. Create a practice routine utilizing

a demo account to try your strategies before risking real capital.

Above all, cultivate patience and discipline. Forex success isn’t achieved overnight; it’s a journey

that needs dedication, consistent learning,

and the capability to adjust to changing market conditions.

By equipping yourself with the right knowledge and mindset, you’ll

be well on the road to navigating the forex market with confidence.

Conclusion

The forex market presents a success of opportunities,

but inaddition it is sold with inherent risks. By diligently acquiring knowledge through

forex trading books, supplementing it with ongoing learning, and

practicing sound risk management, you’ll equip yourself for success in this

dynamic market. Remember, forex trading is a workshop, not really

a sprint. Approach it with consideration, a commitment to continuous learning, and the capacity to adapt,

and you’ll be well on the way to achieving your trading goals.

The foreign exchange market, also called forex, is a dynamic

and ever-changing landscape. Success in this realm needs

a deep understanding of market mechanics, technical analysis, risk

management, and the psychology of trading. Fortunately,

a wealth of knowledge can be acquired at your fingertips

through forex trading books.

This curated list explores five essential books that appeal to both beginner and experienced traders, equipping you with the tools to navigate the forex market with confidence.

Currency Trading for Dummies by Brian Dolan and Kathleen Brooks

This book lives up to the “For Dummies” reputation, supplying a clear and concise introduction to the forex market.

Perfect for newbies, it covers fundamental concepts like currency pairs, market

structure, and the factors influencing exchange rates.

Dolan and Brooks delve into core trading strategies,

risk management techniques, and even the psychology of trading, helping you create a

solid foundation for the forex journey.

Technical Analysis of the Financial Markets by John Murphy

This comprehensive guide by John Murphy is recognized as a bible for technical

analysis. Murphy meticulously explores chart patterns, technical indicators, and

various tools used to forecast price movements. While intended for a broader financial audience,

the principles outlined in this book are highly applicable to forex trading.

By mastering technical analysis, you’ll gain valuable insights into market sentiment and potential trading

opportunities.

Day Trading and Swing Trading the Currency Market by Kathy

Lien

Authored by Kathy Lien, a renowned forex expert, this book delves to the practicalities of trading the

forex market. Lien outlines effective strategies for both

day traders, who capitalize on short-term price fluctuations, and swing

traders, who hold positions for a couple days or weeks.

The book emphasizes the significance of risk management, position sizing, and developing a personalized trading plan tailored to your goals

and risk tolerance.

Market Wizards by Jack Schwager

“Market Wizards” by Jack Schwager isn’t a mainstream forex trading book.

Instead, it offers invaluable insights by interviewing a number of

the world’s most successful traders. Through their personal experiences and trading philosophies,

the book sheds light on the mindsets and approaches that contribute to long-term success in the market.

Whether you’re a novice or seasoned trader, understanding thinking processes of market wizards can significantly enhance your own personal

trading approach.

Trading in the Zone by Mark Douglas

The psychological aspect of trading is often overlooked, nonetheless it holds immense importance.

Mark Douglas’ “Trading in the Zone” tackles the mental game of trading, addressing common psychological pitfalls that plague

traders. He explores topics like fear, greed, and discipline,

equipping you with the mental tools necessary to maintain composure and make sound trading decisions even in the

facial skin of market volatility.

Beyond the Books

While these books provide a solid foundation, remember that forex trading is a continuous learning process.

Supplement your book knowledge with online resources,

educational courses, and real-time market analysis.

Produce a practice routine utilizing a demo account to check your strategies before risking real capital.

Most importantly, cultivate patience and discipline. Forex success isn’t achieved overnight;

it’s a journey that needs dedication, consistent

learning, and the ability to adapt to changing market conditions.

By equipping yourself with the proper knowledge and

mindset, you’ll be well on the road to navigating the forex market with confidence.

Conclusion

The forex market presents a wealth of opportunities, but it

also includes inherent risks. By diligently acquiring knowledge through forex trading books, supplementing it with

ongoing learning, and practicing sound risk management, you’ll equip yourself for

success in this dynamic market. Remember, forex

trading is a workshop, not a sprint. Approach it with

consideration, a commitment to continuous learning, and

the ability to adapt, and you’ll be well on the

road to achieving your trading goals.

The foreign exchange market, also known as forex, is an energetic and ever-changing landscape.

Success in this realm requires a deep knowledge of market mechanics, technical analysis, risk management, and the psychology of trading.

Fortunately, a wealth of knowledge can be obtained at your

fingertips through forex trading books.

This curated list explores five essential books that cater to

both beginner and experienced traders, equipping you with the various

tools to navigate the forex market with confidence.

Currency Trading for Dummies by Brian Dolan and Kathleen Brooks

This book lives up to the “For Dummies” reputation, offering a clear and concise

introduction to the forex market. Perfect for novices, it covers fundamental concepts like currency

pairs, market structure, and the factors influencing exchange rates.

Dolan and Brooks delve into core trading strategies, risk management techniques, and

even the psychology of trading, helping you create a solid

foundation for the forex journey.

Technical Analysis of the Financial Markets by John Murphy

This comprehensive guide by John Murphy is recognized as a bible for technical analysis.

Murphy meticulously explores chart patterns, technical

indicators, and various tools used to forecast

price movements. While aimed at a broader financial audience, the

principles outlined in this book are highly applicable to forex trading.

By mastering technical analysis, you’ll gain valuable

insights into market sentiment and potential trading opportunities.

Day Trading and Swing Trading the Currency Market by

Kathy Lien

Authored by Kathy Lien, a renowned forex expert, this

book delves to the practicalities of trading the forex market.

Lien outlines effective strategies for both day traders, who capitalize on short-term price fluctuations, and swing traders, who hold positions for some days or weeks.

The book emphasizes the significance of risk management,

position sizing, and having a personalized trading plan tailored to your

goals and risk tolerance.

Market Wizards by Jack Schwager

“Market Wizards” by Jack Schwager isn’t an old-fashioned forex trading book.

Instead, it includes invaluable insights by interviewing some of the world’s most successful traders.

Through their personal experiences and trading philosophies, the book sheds light on the mindsets and approaches that contribute to long-term success in the

market. Whether you’re a starter or seasoned trader, understanding the thought processes of market wizards can significantly enhance your personal trading approach.

Trading in the Zone by Mark Douglas

The psychological facet of trading is usually

overlooked, but it holds immense importance. Mark Douglas’ “Trading in the Zone” tackles the mental

game of trading, addressing common psychological pitfalls that

plague traders. He explores topics like fear, greed,

and discipline, equipping you with the mental tools necessary

to keep composure and make sound trading decisions even in the face of market volatility.

Beyond the Books

While these books provide a strong foundation, understand that forex

trading is just a continuous learning process. Supplement your book knowledge with online resources,

educational courses, and real-time market analysis.

Produce a practice routine utilizing a demo account to test your strategies before risking real capital.

Most of all, cultivate patience and discipline. Forex success

isn’t achieved overnight; it’s a journey that needs

dedication, consistent learning, and the ability to adjust

to changing market conditions. By equipping yourself with the best knowledge and mindset,

you’ll be well on the way to navigating the forex market with

confidence.

Conclusion

The forex market presents a wealth of opportunities, but it also is sold

with inherent risks. By diligently acquiring knowledge through forex trading books, supplementing it with ongoing learning, and practicing sound risk management, you’ll equip yourself for success in this dynamic market.

Remember, forex trading is a workshop, not really a sprint.

Approach it with consideration, a commitment to continuous learning, and the ability to adapt, and you’ll be well on your way to achieving your trading goals.

Howdy! This post couldn’t be written any better! Reading through this post reminds me of my previous room mate!

He always kept talking about this. I will forward this article to him.

Pretty sure he will have a good read. Thanks for sharing!

психолог недорого москва w-495.ru

botoks botoks ilacı satın al

Hello, for all time i used to check blog posts here early in the break of day, since i enjoy to learn more and more.

The foreign exchange market, or Forex, beckons

aspiring traders with the promise of high returns and thrilling opportunities.

However, the street to success in this dynamic market is paved

not just with technical analysis and market knowledge,

but also with emotional control. The human mind is wired for

survival, not for navigating the often-unpredictable world

of Forex. Fear, greed, excitement, and overconfidence can easily cloud judgment and lead to impulsive decisions that erode your capital.

This guide equips you with the knowledge to overcome

common trading psychology pitfalls and develop strategies for emotional control.

By mastering your emotions, you may make informed decisions,

implement your trading plan effectively, and navigate the exciting world

of Forex with greater confidence.

Understanding Common Emotional Traps:

Fear: Fear of losing can cause exiting winning positions prematurely or avoiding potentially profitable

trades altogether. This fear can also cause paralysis, preventing you from taking necessary

actions.

Greed: The desire for excessive profits can cloud your judgment.

You could store losing positions for too much time, dreaming about a miraculous turnaround,

or overextend your capital by accepting excessive risk.

Excitement: The thrill of a profitable trade can trigger overconfidence, leading to

reckless trading decisions like ignoring risk

management principles or chasing unrealistic profits.

This excitement can quickly develop into disappointment and

significant losses.

Revenge Trading: The urge to recoup losses after a setback can cause emotionally charged trades without sound strategy.

This often results in further losses, amplifying the first

pain.

Strategies for Emotional Control:

Create a Trading Plan and Stay glued to It: Create a well-defined

trading plan that outlines your entry and exit points, risk management strategies, and position sizing.

Staying with your plan, irrespective of emotional fluctuations,

helps maintain discipline and avoids impulsive decisions.

Practice Risk Management: Implement robust risk management practices.

This includes using stop-loss orders to limit potential losses,

maintaining an effective position size based on your own risk tolerance, and avoiding overleveraging your capital.

Risk management safeguards your capital and prevents emotional

decisions driven by anxiety about losing everything.

Maintain a Trading Journal: Track your trades in a journal, recording details

like entry and exit points, the rationale behind the trade, and the outcome.

Analyze your entries regularly to identify recurring emotional patterns.

Did fear cause you to exit a profitable trade too early?

Did greed lead you to carry onto a losing position for too

much time? Recognizing these patterns empowers you to modify your approach and make

more objective decisions in the future.

Manage Your Expectations: Understand that Forex trading involves inherent risks, and consistent profits don’t

come overnight. Set realistic expectations and prioritize long-term success over short-term gains.

This prevents emotional swings based on temporary market fluctuations.

Practice Emotional Awareness: Recognize how your emotions affect your trading decisions.

Take breaks when feeling overwhelmed by emotions such as for example fear, excitement, or frustration. Avoid

trading underneath the influence of strong emotions, as they can cloud your

judgment. Techniques like meditation or deep breathing can assist you

to center yourself before entering a trade.

Creating a Growth Mindset:

A fruitful Forex trader embraces a growth mindset.

View losses as learning opportunities, analyze what went wrong,

and adjust your strategy accordingly. Continuous learning and

adapting your approach predicated on market conditions and

self-reflection are crucial for long-term success.

Don’t let emotions like disappointment or frustration paralyze you after having a loss.

Instead, put it to use as to be able to improve your skills and become a better trader.

The Great things about Emotional Control:

By mastering your emotions, you gain control over

your trading decisions and experience several benefits:

Reduced Stress and Improved Trading Experience: Managing

emotions removes unnecessary stress and anxiety from trading,

allowing you to approach the marketplace with greater calmness and focus.

You possibly can make well-considered decisions based on your own trading plan and market analysis,

not fear or greed.

Improved Risk Management: Emotional control empowers one to stick to your

risk management plan and avoid impulsive decisions

that will lead to significant losses. You are able to

objectively assess potential trades and prioritize protecting

your capital.

Enhanced Discipline and Consistency: A disciplined approach enables you to execute your trading plan consistently,

ultimately causing improved overall performance.

You are able to avoid emotional biases and make rational decisions that align with your long-term trading goals.

Conclusion

Trading psychology is an essential part of Forex trading success.

By understanding the impact of emotions, developing strategies for emotional control, and cultivating a growth mindset, you are

able to overcome common pitfalls and navigate the exciting world of Forex with greater confidence.

Remember, consistent effort, continuous learning, and emotional mastery would be the keys to unlocking your full potential as a Forex trader.

With emotional control at the forefront, you can make informed decisions, implement your trading plan effectively, and

achieve your long-term trading goals.

The foreign exchange market, or Forex, beckons aspiring traders with the promise of high returns and thrilling opportunities.

However, the street to success in this dynamic market

is paved not merely with technical analysis and market knowledge, but in addition with emotional control.

The human mind is wired for survival, not for navigating the often-unpredictable world of Forex.

Fear, greed, excitement, and overconfidence can easily cloud judgment and cause impulsive decisions that erode your capital.

This guide equips you with the information to overcome common trading psychology pitfalls and develop strategies for emotional

control. By mastering your emotions, you possibly can make informed decisions,

implement your trading plan effectively, and navigate the exciting world of Forex with greater confidence.

Understanding Common Emotional Traps:

Fear: Anxiety about losing can lead to exiting winning positions

prematurely or avoiding potentially profitable

trades altogether. This fear may also cause paralysis,

preventing you from taking necessary actions.

Greed: The desire for excessive profits can cloud your judgment.

You may keep losing positions for too long, hoping for a miraculous turnaround, or

overextend your capital by dealing with excessive risk.

Excitement: The thrill of a winning trade can trigger overconfidence, ultimately causing reckless trading decisions like

ignoring risk management principles or chasing unrealistic profits.

This excitement can quickly turn into disappointment and significant losses.

Revenge Trading: The urge to recoup losses after having a setback can result in emotionally charged trades lacking sound strategy.

This often results in further losses, amplifying the first pain.

Strategies for Emotional Control:

Create a Trading Plan and Adhere to It: Produce a well-defined trading plan that outlines your entry and exit points, risk management strategies, and

position sizing. Sticking with your plan, aside from emotional fluctuations,

helps maintain discipline and avoids impulsive decisions.

Practice Risk Management: Implement robust risk management

practices. This includes using stop-loss orders to limit

potential losses, maintaining an effective position size

based in your risk tolerance, and avoiding overleveraging your capital.

Risk management safeguards your capital and prevents emotional

decisions driven by concern with losing everything.

Maintain a Trading Journal: Track your trades in a journal, recording details like entry and exit points, the explanation behind

the trade, and the outcome. Analyze your entries regularly to spot recurring emotional patterns.

Did fear cause one to exit a successful trade too early?

Did greed lead you to put up onto a losing position for too long?

Recognizing these patterns empowers you to adjust your approach and

make more objective decisions in the future.

Manage Your Expectations: Recognize that Forex trading involves inherent risks, and

consistent profits don’t come overnight. Set realistic expectations and prioritize long-term success over short-term gains.

This prevents emotional swings predicated on temporary market fluctuations.

Practice Emotional Awareness: Recognize how your emotions

affect your trading decisions. Take breaks

when feeling overwhelmed by emotions such as for example

fear, excitement, or frustration. Avoid trading underneath the influence of strong emotions, as they

could cloud your judgment. Techniques like meditation or deep breathing can help you center yourself before entering a trade.

Creating a Growth Mindset:

A successful Forex trader embraces a growth mindset.

View losses as learning opportunities, analyze what went wrong,

and adjust your strategy accordingly. Continuous learning and adapting your approach based on market conditions and self-reflection are crucial for long-term success.

Don’t let emotions like disappointment or frustration paralyze you following a loss.

Instead, put it to use as a chance to boost your skills and turn into a better

trader.

The Benefits of Emotional Control:

By mastering your emotions, you gain control over your trading decisions and experience several benefits:

Reduced Stress and Improved Trading Experience: Managing emotions removes unnecessary

stress and anxiety from trading, allowing you to approach the market with greater calmness and

focus. You can make well-considered decisions based in your trading plan and market analysis, not fear or greed.

Improved Risk Management: Emotional control empowers one to

adhere to your risk management plan and avoid impulsive decisions that can result in significant losses.

You can objectively assess potential trades and prioritize protecting your capital.

Enhanced Discipline and Consistency: A disciplined approach allows

you to execute your trading plan consistently, resulting in improved overall

performance. You can avoid emotional biases and make rational decisions that align along with your long-term trading goals.

Conclusion

Trading psychology is a vital part of Forex trading success.

By understanding the impact of emotions, developing strategies for

emotional control, and cultivating a growth mindset,

you can overcome common pitfalls and navigate the exciting world of Forex with greater confidence.

Remember, consistent effort, continuous learning, and emotional mastery are the keys to unlocking your full potential as a Forex

trader. With emotional control at the forefront, you can make informed decisions, implement your

trading plan effectively, and achieve your long-term trading goals.

The foreign exchange market, or Forex, beckons aspiring traders with the promise

of high returns and thrilling opportunities. However, the trail to success in this

dynamic market is paved not only with technical analysis and

market knowledge, but in addition with emotional control.

The human mind is wired for survival, not

for navigating the often-unpredictable world of Forex.

Fear, greed, excitement, and overconfidence can quickly cloud

judgment and cause impulsive decisions that erode your capital.

This guide equips you with the information to overcome common trading psychology pitfalls and develop strategies for emotional control.

By mastering your emotions, you can make

informed decisions, implement your trading plan effectively, and navigate the exciting world of Forex with

greater confidence.

Understanding Common Emotional Traps:

Fear: Anxiety about losing can lead to exiting winning positions prematurely or avoiding potentially profitable trades altogether.

This fear can also cause paralysis, preventing

you from taking necessary actions.

Greed: The desire for excessive profits can cloud your judgment.

You may keep losing positions for too long, dreaming about a miraculous turnaround, or overextend your capital by accepting

excessive risk.

Excitement: The thrill of a winning trade can trigger overconfidence, resulting in reckless trading decisions like ignoring risk management

principles or chasing unrealistic profits. This excitement can quickly turn into disappointment and

significant losses.

Revenge Trading: The urge to recoup losses after having a setback can cause emotionally charged trades without sound strategy.

This often results in further losses, amplifying

the initial pain.

Strategies for Emotional Control:

Create a Trading Plan and Stay glued to It: Create

a well-defined trading plan that outlines your entry and exit points, risk management strategies,

and position sizing. Sticking with your plan, aside from

emotional fluctuations, helps maintain discipline and avoids impulsive decisions.

Practice Risk Management: Implement robust risk management practices.

Including using stop-loss orders to limit potential losses, maintaining an effective position size based on your own risk tolerance, and avoiding overleveraging your capital.

Risk management safeguards your capital and prevents emotional decisions driven by fear of losing everything.

Maintain a Trading Journal: Track your trades in a journal,

recording details like entry and exit points, the rationale behind the trade, and

the outcome. Analyze your entries regularly to recognize recurring emotional patterns.

Did fear cause you to exit a successful trade too

early? Did greed lead you to hold onto a losing position for too much time?

Recognizing these patterns empowers you to modify your approach and make more

objective decisions in the future.

Manage Your Expectations: Understand that Forex trading involves inherent risks,

and consistent profits don’t come overnight. Set realistic expectations and prioritize long-term success over short-term gains.

This prevents emotional swings predicated on temporary market fluctuations.

Practice Emotional Awareness: Recognize how your emotions affect

your trading decisions. Take breaks when feeling overwhelmed by emotions such as for example fear, excitement, or frustration. Avoid trading beneath the

influence of strong emotions, as they could cloud your judgment.

Techniques like meditation or deep breathing can allow you to center yourself before entering a trade.

Developing a Growth Mindset:

A successful Forex trader embraces a growth mindset.

View losses as learning opportunities, analyze what went wrong,

and adjust your strategy accordingly. Continuous learning and adapting your

approach centered on market conditions and self-reflection are crucial for long-term success.

Don’t let emotions like disappointment or frustration paralyze you after a

loss. Instead, use it as to be able to boost your skills and develop into

a better trader.

The Great things about Emotional Control:

By mastering your emotions, you gain control over your trading decisions

and experience several benefits:

Reduced Stress and Improved Trading Experience: Managing

emotions removes unnecessary stress and anxiety from trading,

enabling you to approach the marketplace with greater calmness and focus.

You may make well-considered decisions based in your trading plan and market analysis, not fear or

greed.

Improved Risk Management: Emotional control empowers one to stick to your risk management plan and avoid impulsive decisions that may cause significant losses.

You are able to objectively assess potential trades and prioritize

protecting your capital.

Enhanced Discipline and Consistency: A disciplined approach enables you to

execute your trading plan consistently, resulting in improved overall performance.

You can avoid emotional biases and make rational decisions that align with your long-term

trading goals.

Conclusion

Trading psychology is an essential aspect of Forex trading success.

By understanding the impact of emotions, developing strategies for emotional control, and cultivating

a growth mindset, you are able to overcome common pitfalls and navigate the

exciting world of Forex with greater confidence.

Remember, consistent effort, continuous learning, and emotional

mastery would be the keys to unlocking your full potential as a Forex trader.

With emotional control at the forefront, you may make informed decisions, implement your trading plan effectively, and achieve your long-term trading goals.

The foreign exchange market, or Forex, beckons aspiring traders

with the promise of high returns and thrilling opportunities.

However, the trail to success in this dynamic market is

paved not only with technical analysis and market knowledge, but also

with emotional control. The human mind is wired for survival, not for navigating the often-unpredictable

world of Forex. Fear, greed, excitement, and overconfidence can quickly cloud judgment and lead

to impulsive decisions that erode your capital.

This guide equips you with the information to overcome common trading psychology pitfalls and develop strategies

for emotional control. By mastering your emotions, you possibly can make informed decisions, implement your trading plan effectively,

and navigate the exciting world of Forex with greater confidence.

Understanding Common Emotional Traps:

Fear: Fear of losing can lead to exiting winning

positions prematurely or avoiding potentially profitable trades altogether.

This fear also can cause paralysis, preventing you from taking necessary actions.

Greed: The desire for excessive profits can cloud your judgment.

You could keep losing positions for a long time, dreaming about a miraculous turnaround, or overextend your capital by taking on excessive risk.

Excitement: The thrill of a successful trade can trigger overconfidence, leading to reckless

trading decisions like ignoring risk management principles or chasing unrealistic profits.

This excitement can quickly become disappointment and significant losses.

Revenge Trading: The urge to recoup losses

after a setback can result in emotionally charged trades devoid of sound strategy.

This often results in further losses, amplifying the first pain.

Strategies for Emotional Control:

Produce a Trading Plan and Stick to It: Develop a well-defined trading

plan that outlines your entry and exit points, risk management strategies, and position sizing.

Sticking to your plan, regardless of emotional fluctuations, helps maintain discipline and

avoids impulsive decisions.

Practice Risk Management: Implement robust risk management practices.

Including using stop-loss orders to limit potential losses, maintaining an effective position size based

in your risk tolerance, and avoiding overleveraging your

capital. Risk management safeguards your capital and prevents emotional decisions driven by fear of losing everything.

Maintain a Trading Journal: Track your trades in a journal,

recording details like entry and exit points, the explanation behind the

trade, and the outcome. Analyze your entries regularly to

identify recurring emotional patterns. Did fear cause you to exit a successful trade

too soon? Did greed lead you to put up onto a losing position for

a long time? Recognizing these patterns empowers you to modify your approach and make more objective decisions

in the future.

Manage Your Expectations: Recognize that Forex trading involves inherent risks, and consistent

profits don’t come overnight. Set realistic expectations and prioritize

long-term success over short-term gains. This prevents emotional swings based on temporary market fluctuations.

Practice Emotional Awareness: Recognize how your emotions affect your trading decisions.

Take breaks when feeling overwhelmed by emotions such as for

example fear, excitement, or frustration. Avoid trading under the influence of strong

emotions, as they can cloud your judgment. Techniques like meditation or deep breathing can help you center yourself before entering a trade.

Having a Growth Mindset:

A fruitful Forex trader embraces a growth mindset.

View losses as learning opportunities, analyze what went wrong, and adjust

your strategy accordingly. Continuous learning and adapting your approach centered on market conditions and

self-reflection are crucial for long-term success.

Don’t let emotions like disappointment or frustration paralyze you after having

a loss. Instead, utilize it as to be able to improve your skills

and develop into a better trader.

The Great things about Emotional Control:

By mastering your emotions, you gain control over your trading decisions

and experience several benefits:

Reduced Stress and Improved Trading Experience: Managing emotions removes unnecessary stress and anxiety from trading, enabling

you to approach industry with greater calmness and focus.

You can make well-considered decisions based on your

trading plan and market analysis, not fear or greed.

Improved Risk Management: Emotional control empowers one to adhere to your risk management plan and avoid impulsive decisions that may result in significant losses.

You can objectively assess potential trades and prioritize protecting your capital.

Enhanced Discipline and Consistency: A disciplined approach

lets you execute your trading plan consistently, leading to improved overall

performance. You can avoid emotional biases and make rational decisions that align with

your long-term trading goals.

Conclusion

Trading psychology is a vital facet of Forex trading success.

By understanding the impact of emotions, developing strategies for emotional

control, and cultivating a growth mindset, you can overcome common pitfalls and navigate the exciting world of Forex

with greater confidence. Remember, consistent effort, continuous learning, and

emotional mastery will be the keys to unlocking your

full potential as a Forex trader. With emotional control at the forefront, you possibly can make informed decisions, implement your trading plan effectively, and achieve

your long-term trading goals.

The foreign exchange market, or Forex, beckons aspiring traders

with the promise of high returns and thrilling opportunities.

However, the trail to success in this dynamic market is paved not just with technical analysis and market knowledge, but in addition with emotional control.

The human mind is wired for survival, not for navigating the often-unpredictable world of Forex.

Fear, greed, excitement, and overconfidence can quickly cloud judgment

and result in impulsive decisions that erode your capital.

This guide equips you with the data to overcome common trading psychology pitfalls and develop

strategies for emotional control. By mastering your emotions,

you can make informed decisions, implement your trading plan effectively, and navigate the exciting world of Forex with greater confidence.

Understanding Common Emotional Traps:

Fear: Anxiety about losing can cause exiting winning positions prematurely

or avoiding potentially profitable trades altogether. This fear also can cause paralysis, preventing

you from taking necessary actions.

Greed: The desire for excessive profits can cloud your

judgment. You could hold onto losing positions for too much time, dreaming about a miraculous turnaround,

or overextend your capital by dealing with excessive risk.

Excitement: The thrill of a winning trade can trigger overconfidence, leading to reckless trading decisions like ignoring risk management principles or chasing unrealistic profits.

This excitement can quickly develop into disappointment

and significant losses.

Revenge Trading: The urge to recoup losses after a setback can lead to emotionally charged trades lacking sound

strategy. This often results in further losses, amplifying the original pain.

Strategies for Emotional Control:

Create a Trading Plan and Stick to It: Create a well-defined trading plan that outlines your entry and exit points, risk management strategies, and position sizing.

Staying with your plan, irrespective of emotional fluctuations, helps

maintain discipline and avoids impulsive decisions.

Practice Risk Management: Implement robust risk management

practices. This includes using stop-loss orders to limit potential losses, maintaining a suitable position size based on your risk tolerance, and avoiding overleveraging your capital.

Risk management safeguards your capital and

prevents emotional decisions driven by concern with losing everything.

Maintain a Trading Journal: Track your trades in a journal, recording

details like entry and exit points, the explanation behind

the trade, and the outcome. Analyze your

entries regularly to spot recurring emotional patterns.

Did fear cause you to exit a profitable trade too early?

Did greed lead you to keep onto a losing position for too much time?

Recognizing these patterns empowers you to regulate your approach and make

more objective decisions in the future.

Manage Your Expectations: Recognize that Forex trading involves inherent

risks, and consistent profits don’t come overnight.

Set realistic expectations and prioritize long-term success over short-term gains.

This prevents emotional swings based on temporary market fluctuations.

Practice Emotional Awareness: Recognize how your emotions affect your

trading decisions. Take breaks when feeling overwhelmed by emotions such as fear, excitement,

or frustration. Avoid trading beneath the influence of strong emotions, as they are able to cloud your judgment.

Techniques like meditation or deep breathing can assist you

to center yourself before entering a trade.

Having a Growth Mindset:

An effective Forex trader embraces a growth mindset. View losses as learning opportunities,

analyze what went wrong, and adjust your strategy accordingly.

Continuous learning and adapting your approach centered

on market conditions and self-reflection are crucial for long-term success.

Don’t let emotions like disappointment or frustration paralyze you following a loss.

Instead, use it as a chance to boost your skills and turn into a better trader.

The Advantages of Emotional Control:

By mastering your emotions, you gain control over your trading decisions and experience several benefits:

Reduced Stress and Improved Trading Experience: Managing emotions removes unnecessary stress and anxiety from trading,

letting you approach the marketplace with greater calmness and focus.

You possibly can make well-considered decisions based in your trading plan and market analysis, not fear or greed.

Improved Risk Management: Emotional control empowers one to adhere to your risk management plan and avoid impulsive decisions that will cause significant losses.

You can objectively assess potential trades and prioritize protecting your capital.

Enhanced Discipline and Consistency: A disciplined approach allows you to

execute your trading plan consistently, leading to improved

overall performance. You can avoid emotional biases and make rational

decisions that align with your long-term trading goals.

Conclusion

Trading psychology is an essential part of Forex trading success.

By understanding the impact of emotions, developing strategies for emotional control, and cultivating a growth

mindset, you are able to overcome common pitfalls and navigate the exciting world of Forex with greater confidence.

Remember, consistent effort, continuous learning,

and emotional mastery will be the keys to unlocking your full potential as a Forex trader.

With emotional control at the forefront, you possibly can make

informed decisions, implement your trading plan effectively, and achieve your long-term trading goals.

The foreign exchange market, or Forex, beckons aspiring traders with the promise of high

returns and thrilling opportunities. However, the street to success in this dynamic market is paved not merely

with technical analysis and market knowledge, but also with emotional control.

The human mind is wired for survival, not for navigating the often-unpredictable world of Forex.

Fear, greed, excitement, and overconfidence can very quickly cloud judgment and cause

impulsive decisions that erode your capital.

This guide equips you with the information to overcome common trading psychology pitfalls and develop strategies for emotional control.

By mastering your emotions, you possibly can make informed decisions,

implement your trading plan effectively, and navigate the

exciting world of Forex with greater confidence.

Understanding Common Emotional Traps:

Fear: Fear of losing can lead to exiting winning positions prematurely or avoiding potentially profitable

trades altogether. This fear can also cause paralysis, preventing you from taking necessary actions.

Greed: The desire for excessive profits can cloud your judgment.

You could hold onto losing positions for too long, hoping for a miraculous turnaround, or overextend your capital by accepting

excessive risk.

Excitement: The thrill of a profitable trade can trigger

overconfidence, leading to reckless trading decisions like ignoring risk

management principles or chasing unrealistic profits.

This excitement can quickly turn into disappointment

and significant losses.

Revenge Trading: The urge to recoup losses after

a setback can cause emotionally charged trades devoid of sound strategy.

This often results in further losses, amplifying the original pain.

Strategies for Emotional Control:

Produce a Trading Plan and Stick to It: Develop a

well-defined trading plan that outlines your entry and exit points,

risk management strategies, and position sizing. Sticking with your plan, irrespective of emotional fluctuations, helps maintain discipline and avoids impulsive decisions.

Practice Risk Management: Implement robust risk management practices.

Including using stop-loss orders to limit potential losses, maintaining a suitable position size based on your risk

tolerance, and avoiding overleveraging your capital.

Risk management safeguards your capital and prevents emotional

decisions driven by concern with losing everything.

Maintain a Trading Journal: Track your trades in a journal, recording details like entry and exit points,

the rationale behind the trade, and the outcome. Analyze your entries regularly to identify recurring emotional

patterns. Did fear cause one to exit a winning trade too soon? Did greed lead you to keep

onto a losing position for a long time? Recognizing these patterns empowers you

to modify your approach and make more objective decisions in the future.

Manage Your Expectations: Understand that Forex trading involves

inherent risks, and consistent profits don’t come overnight.

Set realistic expectations and prioritize long-term success over short-term gains.

This prevents emotional swings based on temporary

market fluctuations.

Practice Emotional Awareness: Recognize how your emotions affect your trading decisions.

Take breaks when feeling overwhelmed by emotions such as fear,

excitement, or frustration. Avoid trading beneath the influence of strong

emotions, as they are able to cloud your judgment.

Techniques like meditation or deep breathing can help you center yourself

before entering a trade.

Having a Growth Mindset:

A fruitful Forex trader embraces a growth mindset.

View losses as learning opportunities, analyze what went wrong,

and adjust your strategy accordingly. Continuous learning

and adapting your approach based on market conditions

and self-reflection are crucial for long-term success. Don’t let emotions like disappointment or frustration paralyze

you after a loss. Instead, use it as to be able to enhance

your skills and turn into a better trader.

The Benefits of Emotional Control:

By mastering your emotions, you gain control over your trading decisions and experience several benefits:

Reduced Stress and Improved Trading Experience: Managing emotions removes unnecessary stress and

anxiety from trading, allowing you to approach the market with greater calmness and

focus. You can make well-considered decisions based on your own trading plan and market

analysis, not fear or greed.

Improved Risk Management: Emotional control empowers one to stay glued to your risk management plan and avoid impulsive decisions that will lead to significant losses.

You are able to objectively assess potential trades and

prioritize protecting your capital.

Enhanced Discipline and Consistency: A disciplined approach

enables you to execute your trading plan consistently, ultimately causing improved overall performance.

You can avoid emotional biases and make rational decisions

that align along with your long-term trading goals.

Conclusion

Trading psychology is an essential part of Forex trading success.

By understanding the impact of emotions, developing strategies for emotional control,

and cultivating a growth mindset, you are able to overcome common pitfalls and navigate the exciting

world of Forex with greater confidence. Remember, consistent effort,

continuous learning, and emotional mastery will be the keys to unlocking your full potential as a Forex trader.

With emotional control at the forefront, you can make informed decisions, implement

your trading plan effectively, and achieve your long-term trading goals.

The foreign exchange market, or Forex, beckons with the

allure of high returns and exciting opportunities. However, venturing into this

dynamic market requires a foundation of trust.

Your Forex broker, the platform you utilize to execute trades and access

market data, plays a crucial role. Transparency is paramount – a

broker that operates openly and discloses vital

information fosters trust and empowers informed decision-making.

This guide equips you with the knowledge to recognize trustworthy Forex

brokers by evaluating their level of transparency. By prioritizing these factors, you can choose a reliable partner for your

Forex trading journey.

Understanding Transparency in Forex Brokers:

Disclosure of Fees and Charges: A clear broker clearly outlines

all fees and charges related to trading. Including spreads (the difference involving the bid and ask

price), commissions (fees charged per trade), account

maintenance fees, and any inactivity fees. Keep clear of hidden fees or

complex fee structures that may erode your profits.

Execution Transparency: Trustworthy brokers prioritize fair and transparent trade execution.

Look for brokers that disclose their order execution policies,

including order routing practices and potential conflicts

of interest. They should offer info on slippage, that

will be the difference involving the expected price and

the particular execution price of a trade.

Regulatory Compliance: Forex trading is at the mercy of regulations by financial authorities.

Choose a broker that is regulated by a trustworthy body, including the Financial Conduct Authority

(FCA) in the UK, the National Futures Association (NFA) in the US,

or the Australian Securities and Investments Commission (ASIC) in Australia.

Regulation ensures consumer protection and adherence to fair trading

practices.

Identifying Transparency in Action:

Clear and Accessible Information: A trustworthy broker presents informative data on fees, charges, order execution policies, and risk disclosures

on the website in an obvious and readily available format.

This information should really be written in plain language and avoid complex jargon.

Regular Account Statements and Reporting: Transparent brokers

provide clients with regular and detailed account

statements that clearly show all trading activity, fees charged, and current account balance.

These statements should really be easily obtainable for download

or accessible by way of a secure online portal.

Market Analysis and Educational Resources: Whilst not strictly transparency, brokers offering market analysis, educational resources, and trading tools demonstrate a commitment to empowering their clients.

This fosters trust and positions them as a reliable partner in your trading

journey.

Red Flags of Non-Transparent Brokers:

Unrealistic Profit Guarantees: Be wary of brokers who guarantee

high returns or minimize the risks involved with Forex trading.

The Forex market is inherently volatile, and no broker can guarantee

profits.

Hidden Fees and Complex Fee Structures: Avoid brokers with hidden fees or complex fee structures

that are difficult to understand. Transparency in fees allows you

to make informed decisions about your trading costs.

Limited Customer Support: A trustworthy broker prioritizes excellent

customer support. If your broker has limited availability or unresponsive

customer service, it raises red flags about their overall transparency and commitment to client satisfaction.

Great things about Selecting a Transparent Forex Broker:

Builds Trust and Confidence: Transparency fosters trust and confidence, enabling you to focus

on your trading strategy without fretting about hidden fees or unfair practices.

Empowers Informed Decisions: Clear information on fees, execution policies, and

risk disclosures allows you to make informed decisions

about your trades and manage your risk effectively.

Promotes a Positive Trading Experience: Trading with

a clear broker enhances your overall trading experience.

You realize precisely what to anticipate with regards to costs, execution, and customer support.

Conclusion

Transparency is just a cornerstone of trust in the

Forex market. By prioritizing transparency when selecting a Forex broker, you choose somebody that prioritizes your interests.

Search for brokers that disclose fees clearly, prioritize fair execution practices,

and operate underneath the regulations of reputable financial authorities.

With a transparent broker by your side, you are able to navigate the

exciting world of Forex with greater confidence and knowledge.

The foreign exchange market, or Forex, beckons with the allure of high returns and exciting opportunities.

However, venturing into this dynamic market requires a

basis of trust. Your Forex broker, the platform you use to execute trades

and access market data, plays a crucial role. Transparency is paramount – a broker that operates openly and discloses vital information fosters trust and empowers informed

decision-making.

This guide equips you with the information to spot trustworthy Forex brokers by evaluating their level of transparency.

By prioritizing these factors, you can make a dependable partner for your Forex trading journey.

Understanding Transparency in Forex Brokers:

Disclosure of Fees and Charges: A clear broker clearly outlines all fees

and charges associated with trading. This includes spreads (the difference

between the bid and ask price), commissions (fees charged per trade), account maintenance fees,

and any inactivity fees. Be wary of hidden fees or complex fee

structures that may erode your profits.

Execution Transparency: Trustworthy brokers prioritize fair and transparent trade

execution. Look for brokers that disclose their order execution policies, including order routing practices and potential

conflicts of interest. They ought to offer home elevators slippage, that

is the difference between the expected price and the actual execution price of a

trade.

Regulatory Compliance: Forex trading is subject to regulations by financial authorities.

Pick a broker that’s regulated by a respected body,

including the Financial Conduct Authority (FCA) in the UK, the

National Futures Association (NFA) in the US, or the

Australian Securities and Investments Commission (ASIC) in Australia.

Regulation ensures consumer protection and adherence to fair trading

practices.

Identifying Transparency in Action:

Clear and Accessible Information: A trustworthy broker presents informative data on fees, charges, order execution policies,

and risk disclosures on the website in a definite and easily accessible format.

These records should be written in plain language and avoid complex jargon.

Regular Account Statements and Reporting: Transparent brokers

provide clients with regular and detailed account statements that clearly show all trading activity, fees charged,

and current account balance. These statements must be readily available for download or accessible by way of a secure online portal.

Market Analysis and Educational Resources:

Whilst not strictly transparency, brokers that offer market analysis, educational

resources, and trading tools demonstrate a commitment to empowering their clients.

This fosters trust and positions them as a dependable

partner in your trading journey.

Red Flags of Non-Transparent Brokers:

Unrealistic Profit Guarantees: Keep clear of brokers who guarantee high returns or

minimize the risks involved with Forex trading.

The Forex market is inherently volatile, and no broker can guarantee profits.

Hidden Fees and Complex Fee Structures: Avoid brokers with hidden fees or complex fee structures that are difficult to understand.

Transparency in fees enables you to make informed decisions about

your trading costs.

Limited Customer Support: A trustworthy broker prioritizes excellent customer support.

If a broker has limited availability or unresponsive

customer care, it raises red flags about their overall transparency and commitment to client satisfaction.

Benefits of Choosing a Transparent Forex Broker:

Builds Trust and Confidence: Transparency fosters trust and confidence, allowing you to focus on your trading strategy without worrying about hidden fees or

unfair practices.

Empowers Informed Decisions: Clear informative data on fees,

execution policies, and risk disclosures lets you make informed decisions about

your trades and manage your risk effectively.

Promotes a Positive Trading Experience: Trading with

a clear broker enhances your overall trading experience. You

realize just what to anticipate in terms of costs, execution, and customer support.

Conclusion

Transparency is just a cornerstone of rely upon the Forex

market. By prioritizing transparency when selecting a Forex broker, you

select someone that prioritizes your interests.

Search for brokers that disclose fees clearly, prioritize fair execution practices, and operate underneath

the regulations of reputable financial authorities.

With a transparent broker by your side, you are able to navigate the exciting world of Forex with greater confidence and knowledge.

lazer epilasyon epilasyon

Hi! This post couldn’t be written any better! Reading this post reminds

me of my old room mate! He always kept chatting about this.

I will forward this article to him. Fairly certain he will have

a good read. Thank you for sharing!